The Bitcoin halving is a big event for miners, marking when the block reward for mining Bitcoin is cut in half. A block reward halving occurs every four years and is designed to slow down the issuance of new bitcoins until it eventually hits 21 Million. With another halving around the corner, miners must look at ways to stay profitable even when their rewards get smaller. This halving epoch marks a move from 6.25 to 3.125 Bitcoin mined per block. At current prices, that's a revenue reduction of $27 million per day for the industry, not counting fees.

To deal with the challenges the halving brings, Foreman can offer essential tools to help miners maximize their site resilience. We’ll cover three key ways to do this: using Firmware to make mining more efficient, cutting costs by making intelligent decisions in real-time, and increasing revenue by taking advantage of changes in electricity demand or Demand Response. These strategies can help miners stay profitable when the halving reduces their rewards. Here are three ways to maximize revenue with Foreman going into the halving.

1. Increase Efficiency with Firmware

The number one way to help maximize revenue is by installing custom firmware. Firmware adjustments ensure that each mining chip operates at optimal frequency and voltage by enabling precise tuning and optimizing ASIC miners. Optimization not only maximizes the hash rate or the mining power of the hardware but also minimizes energy consumption. As a result, miners can achieve a higher output of Bitcoin for a lower input cost, effectively increasing the profitability of their mining activities. In the context of the Bitcoin halving, where mining rewards are reduced, the ability of firmware to squeeze out additional efficiency becomes even more valuable. It offers miners a competitive edge in maintaining and increasing their revenue streams despite the challenges of the halving.

Foreman simplifies the network installation of firmware across numerous ASIC miners, enabling miners to update and manage firmware on multiple devices simultaneously and at scale. The ability to batch firmware updates is crucial for large-scale operations, where updating each miner individually would be time-consuming and impractical. By facilitating swift firmware updates, Foreman ensures that all mining hardware operates with the latest efficiency improvements, helping miners maintain optimal performance and maximize revenue, which is particularly important as they navigate the challenges posed by the Bitcoin halving.

2. Strike Price-based Cost Avoidance

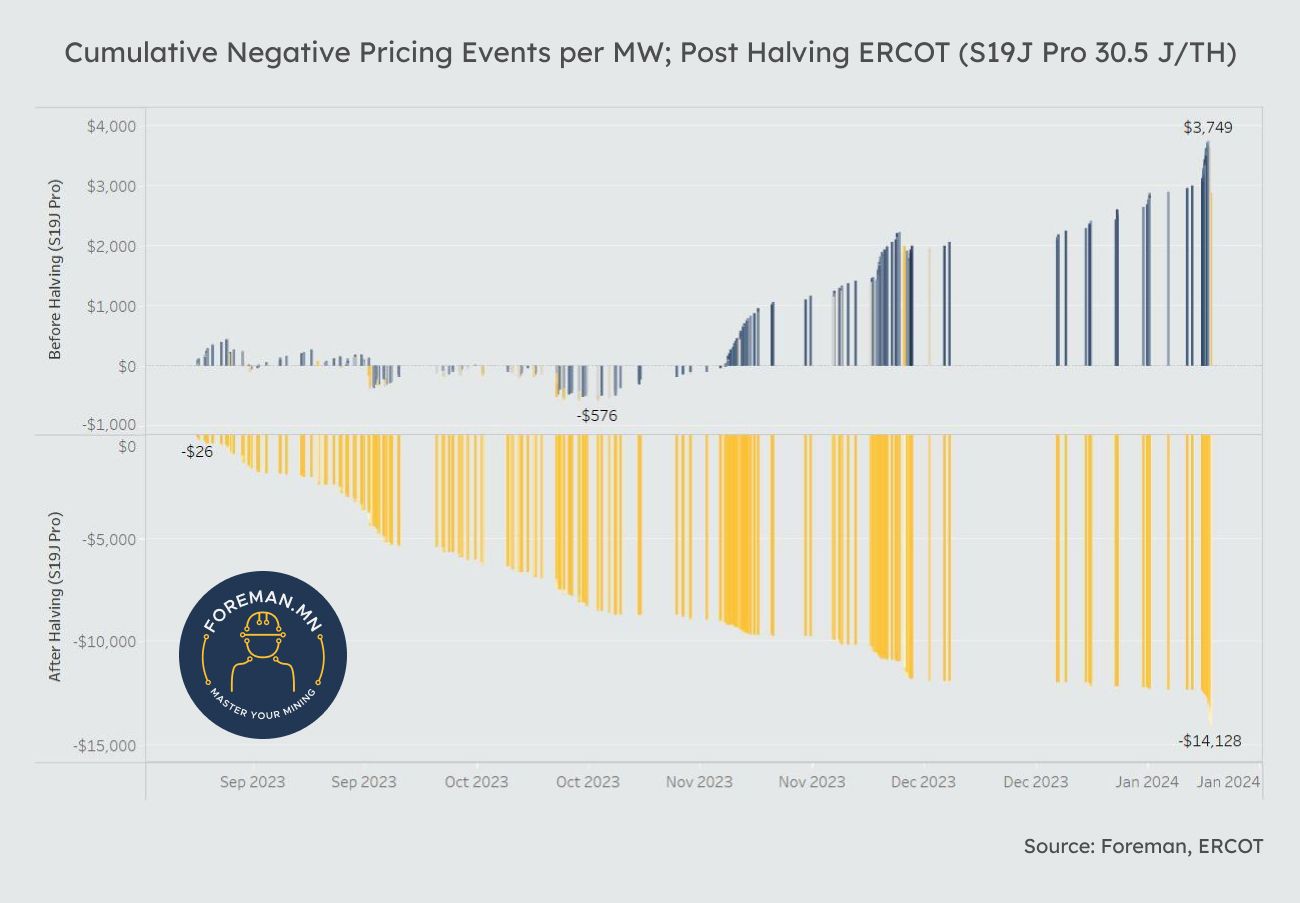

During volatile electricity price fluctuations, Bitcoin miners can significantly benefit from a strategy known as Peak Avoidance. Peak Avoidance is an essential approach for miners on variable power. It involves temporarily halting mining operations when electricity prices spike above a predetermined threshold, thereby preventing mining at a loss. A case study in the ERCOT market demonstrated how utilizing Foreman's automated curtailment feature, based on a machine strike price, enabled miners to avoid high-cost periods, leading to substantial cost savings. The projection of S19J Pro Revenue at 30.5 J/Th will go from $120/Mwh to $60/Mwh after the halving.

The above image compares two scenarios over the past six months. The top is the 6.25 block reward from the halving, and the bottom scenario is a 3.125 block reward as if the halving happened six months ago. With decreased profit margins across the board, older machines will cross the profitability line more often, thus the need for programmatic curtailment.

Methodology:

- Compares 6.25 block reward (top) to 3.125 block reward (bottom)

- Previous six months of real-time index pricing in ERCOT for cost

- Profit is based on the 30.5 J/Th efficiency

- Data points collected are only when the 3.125 block scenario is unprofitable.

The bars only show adverse pricing events for the 3.125 block reward over the past six months. The result is a negative $14,000 per MW on the bottom chart. Scale this up to a multi-MW facility, and that has the possibility of significant losses. The above chart of the 6.25 block reward shows the same pricing events as the 3.125, but overall profitability is a massive change. Over the same period, the pre-halving S19J Pro was much more profitable. It is profitable despite having some adverse pricing events itself. All else being equal, as the revenue gets cut in half going into the halving, there will likely be many more negative profit scenarios that need to be addressed.

Cost avoidance becomes crucial for miners operating in index or real-time pricing areas, such as ERCOT and other Independent System Operators (ISOs). Older mining hardware tends to be less efficient and will find profitability margins increasingly thin after the halving. Given their lower efficiency, these machines are likelier to tip into unprofitability, especially with high electricity prices. These variables emphasize the need for strategic, operational adjustments to mitigate losses and maintain viability in the competitive mining landscape. By leveraging intelligent tools like Price Avoidance, miners can navigate the demand spikes of real-time pricing, ensuring their operations remain profitable even under adverse conditions.

3. Increase Revenue with Demand Response

Demand Response (DR) strategies are essential for balancing electricity consumption with supply, enhancing grid stability and efficiency during demand fluctuations. Bitcoin miners excel in this landscape thanks to their operational flexibility, enabling swift adjustments to energy usage that align with grid demands. Their rapid response capabilities help stabilize the grid and elevate Bitcoin mining to a vital role within the energy sector, outperforming traditional industrial responses.

By engaging in DR programs, Bitcoin miners capitalize on their ability to scale down operations quickly during peak demand times, such as during extreme weather conditions, thus relieving stress on the power grid. These programs, offered by grid operators and utility companies, provide financial rewards for reduced electricity use when most critical, turning potential operational challenges into profitable opportunities. The miners' proficiency in navigating these DR programs highlights a mutually beneficial relationship between the flexible nature of Bitcoin mining operations and the evolving requirements of the modern power grid.

Moreover, strategically pausing mining activities when electricity costs surpass potential mining rewards opens avenues for added revenue, fortifying miners' bottom lines. Participating in DR programs allows miners to earn compensation for reducing energy usage during peak periods, effectively converting what could be unprofitable downtimes into opportunities for additional income. Such strategic decisions avoid high operational costs and place Bitcoin mining at the forefront of energy conservation and intelligent grid management while staying competitive.

As we approach the upcoming Bitcoin halving, miners face challenges and opportunities to sustain and potentially increase profitability. By leveraging advanced tools like Foreman, miners can navigate the complexities of reduced rewards through strategic firmware optimization, cost-effective operational adjustments, and active participation in Demand Response programs. These strategies ensure the efficiency and sustainability of mining operations and contribute to the broader energy ecosystem by providing much-needed flexibility and stability to the grid.