As the 2024 Bitcoin halving unfolded, the volatility observed in the Hashprice and the fee market was noteworthy—almost reminiscent of an emerging currency or GameStop stock. This year’s halving was distinct from its predecessors, marked by pivotal changes and a dramatic yet predictable return to the mean in Hashprice dynamics. But why did this happen, and what implications does it hold for the future?

In this analysis, we will dissect the crucial role of the fee market in shaping the Hashprice dynamics and explore what the future holds for miners as we enter the 5th Epoch of Bitcoin mining.

Runes and BRC-20 at the Halving

The hot “new” thing in town is a new way to make Crypto and NFTs on Bitcoin. Since Taproot was implemented, Ordinal Theory, BRC-20, and Runes have started to emerge and pre-halving, people found a way to make crypto on Bitcoin (again).

The main thing to understand is that these cryptos have been added to Bitcoin's base layer through a proxy of ordinal theory, whether BRC-20 or Runes. That means you need to mint them through a real Bitcoin transaction, which in turn, spikes fees.

At Block height 840,000, or the halving block, a new protocol built by the creator of ordinal theory reduced the size of the minting transactions for BRC-20s, allowing users to create meme coins more efficiently. They are called Runes, and after the halving, there was a dash to “mint” or transact on Bitcoin to capture tickers, almost like domain names.

Halving and Hashprice

In the 4th epoch (2020-2024) bear market environment, Bitcoin transaction fees were around 1-3%. In a normal market, it would continue, and at halving, it would rise to roughly 2-6% of the total block reward. But the fee environment has completely changed since Ordinal NFTs, BRC-20s, and Runes are on Bitcoin. In the short-term at least.

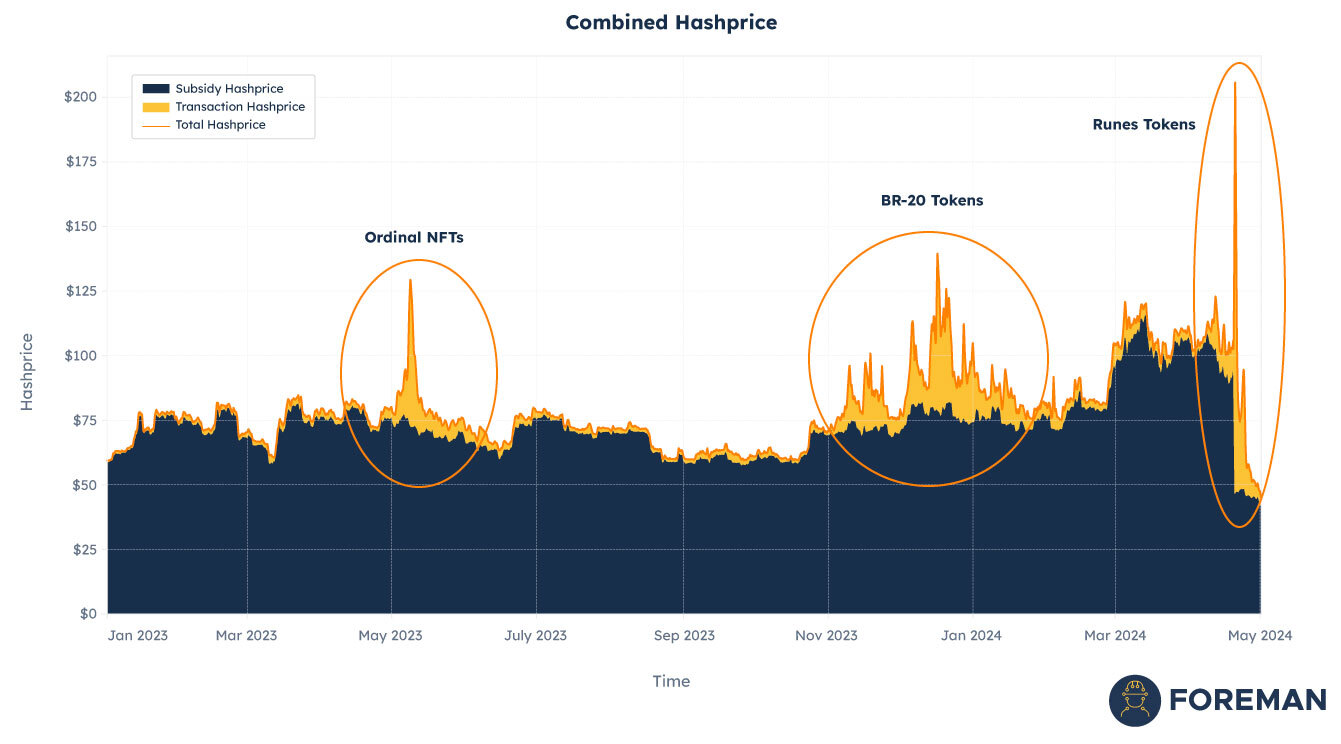

Breaking down Hashprice into two separate categories can help us understand the fee environment better while still looking at Hashprice as a whole. The subsidy is stagnant and only changes during halvings (in BTC terms). But fees (yellow) are much more volatile, changing based on Mempool congestion, and the fee market.

There have been a few significant changes to Hashprice over the past 12 months, and during the bear market, fees started spiking, pushing miner profitability and price upwards. The first spike was when ordinals were released and users started minting NFTs. The Second was BRC-20 tokens, otherwise known as meme coins. The final Spike was the Runes tokens, a more efficient version of BRC-20.

After the halving block, fees spiked as runes took off, and users spent millions minting new Rune Tokens. Some thought the frenzy would last much longer, but minters quickly lost steam, functionally pushing us into the 5th Epoch of Bitcoin mining.

What's In Store For The 5th Epoch

Of course, there is no way to predict the future. But historically, bull markets come every four years due to the halving, which causes a supply crunch. With this comes new adoption and more buyers of Bitcoin, driving up demand for blockspace.

Each bull market brings significant demand for blockspace. But this bull market is functionally different solely because a new type of user has entered the game. People are now minting NFTs and creating tokens on Bitcoin, which could make up a more significant portion of fees than before—at some points, more than 50% of total fee share. Now that there is much more demand for the Bitcoin Fee market it will be interesting to see what happens in this Epoch. A fee market frenzy is surely on the horizon; the real question is, comparatively, how much more?