The AI buzzword has been floating around for years, but we are finally at the point where these tools are becoming accessible to the public, allowing everyday people to leverage them. There seem to be many headlines about company partnerships, but will this be the future of Bitcoin mining?

Recently, many large Bitcoin miners, most of them public miners, have announced that they have some level of involvement with AI. But why are they partnering with AI, and will it last? This article will examine the economics and reality of these hedged Bitcoin/AI data centers.

Why are Bitcoin miners suddenly getting into AI?

Bitcoin miners are increasingly forming partnerships with companies to expand their operations into AI due to the remarkable similarities between the two industries. Both sectors demand vast computing power and robust infrastructure, which Bitcoin miners already possess. This partnership allows for a seemingly easy pivot towards AI GPU infrastructure, capitalizing on their existing resources and expertise. Given the rising demand for AI services across various sectors, the transition is not just strategic but potentially essential. Because of this, there are major advantages to utilizing a single management tool in these collocated facilities.

Moreover, the existing infrastructure enables miners to significantly reduce the time to market when launching AI initiatives. Unlike starting from scratch, miners could adapt their facilities to accommodate AI workloads, streamlining operations and optimizing energy use. This agility in utilizing pre-existing resources positions Bitcoin miners favorably in the rapidly growing AI landscape, ensuring they remain competitive and relevant in an evolving technological environment.

"Crusoe, Blue Owl Capital and Primary Digital Infrastructure Enter $3.4 billion Joint Venture for AI Data Center Development" - Yahoo Finance

"Marathon Digital Explores AI Ventures with New Board Appointments" - TheMinerMag

"Core Scientific Partners with CoreWeave for $6.7 Billion AI Hosting Deal" - Investor’s Business Daily

How are miners participating?

There are a few different ways in which Bitcoin miners are starting to participate, such as adding a hedge to their data center stack. The industry is continually evolving, and according to analysts, these are the current models for participation compared to the general Bitcoin mining model revenue.

AI Hosting Model (Light)

In this model, HPC AI miners lease data center space to large companies that bring and manage their own GPUs. Miners earn around $118 per MWh, with power costs passed to the client. This model is low-cost for miners but generates less revenue.

HPC Deployment Model (Heavy)

In the deployment model, miners invest in their own GPUs and sell computing power to AI clients. It’s more expensive to set up but can generate $1,540 to $3,950 per MWh, offering higher returns than the light model.

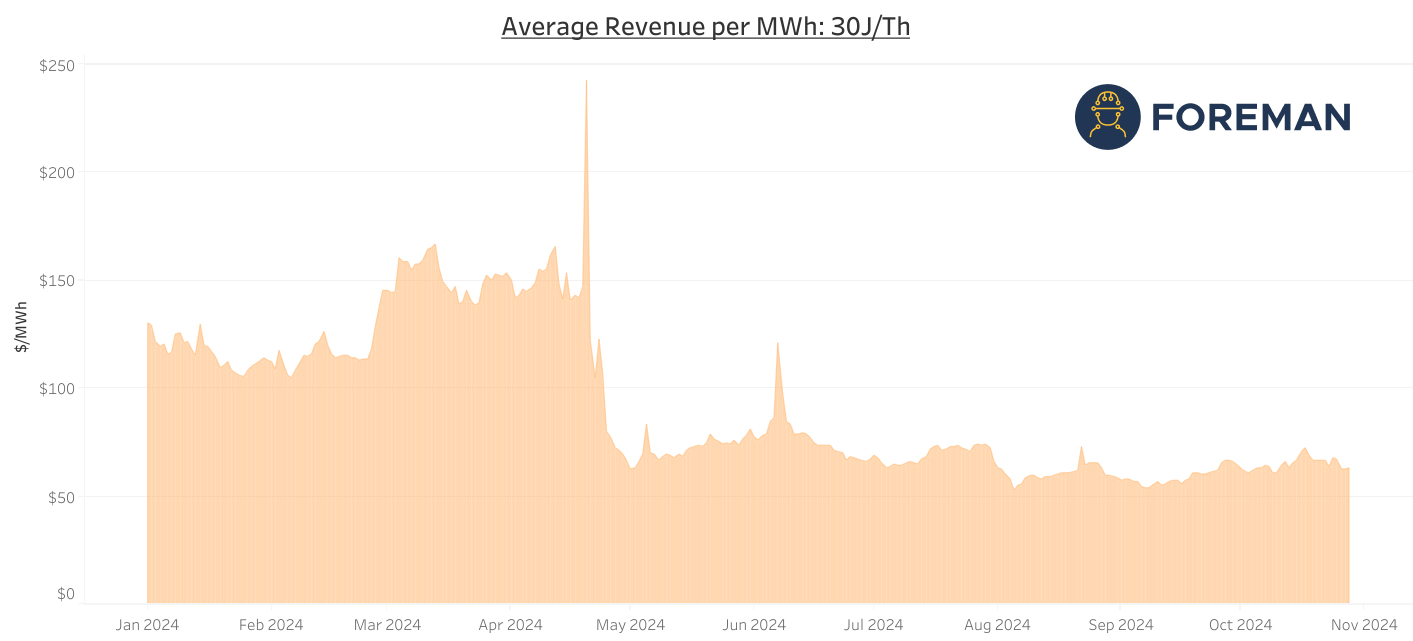

General Bitcoin Mining Model and Profitability

Bitcoin mining revenue depends on the efficiency of mining machines. Older machines, like 30 J/th models, generate around $65 per MWh, while newer 26 J/th machines bring in about $77 per MWh. The latest S21 models, operating at 15 J/th, earn around $130 per MWh, reflecting the increasing profitability of bitcoin mining with newer technology.

How much does it cost to enter AI Computing?

In today's digital landscape, AI computing's profitability is driven by its capacity to manage complex workloads efficiently. Data centers leveraging high-performance GPUs can yield substantial revenues as demand for AI applications grows. The financial metrics associated with AI workloads reflect significant returns, positioning AI computing as a lucrative avenue for investment, particularly for organizations that already possess the necessary infrastructure and expertise.

The capital expenditure (CapEx) to establish an AI data center could range from $12 million to $20 million per megawatt (MW). This cost range is influenced by several factors, including the facility's size, design, and specific technology requirements. Various sources indicate that these prices account for the intricacies of developing a data center optimized for AI operations.

In terms of revenue potential, AI data centers can achieve substantial earnings, as reflected above, while also adding quick deployment. This revenue potential, when paired with the existing infrastructure from Bitcoin mining, allows miners to pivot effectively towards AI computing. So it's no wonder that Bitcoin miners and public ones are doubling down on HPC AI, adding hedges to their current models.