When electricity prices explode to the upside, it is no secret miners must turn off machines to save on costs and avoid high rates. But what if miners were paid for spinning down operations and sending the electricity back to the grid? This solution, known as “Selling Blocks,” is made possible through Foreman’s platform, which allows miners to automatically and precisely target arbitrage opportunities through our unique platform features.

Part One of the “Cost Saving Strategies” series explored how miners could avoid high electricity costs through automated curtailment solutions, during volatile peak pricing periods. In part two, we will delve into how sending power back to the grid can turn that curtailed time into profit, paying the miner on both sides.

“If you still need to read Part 1 on Peak Avoidance, check it out for more context.”

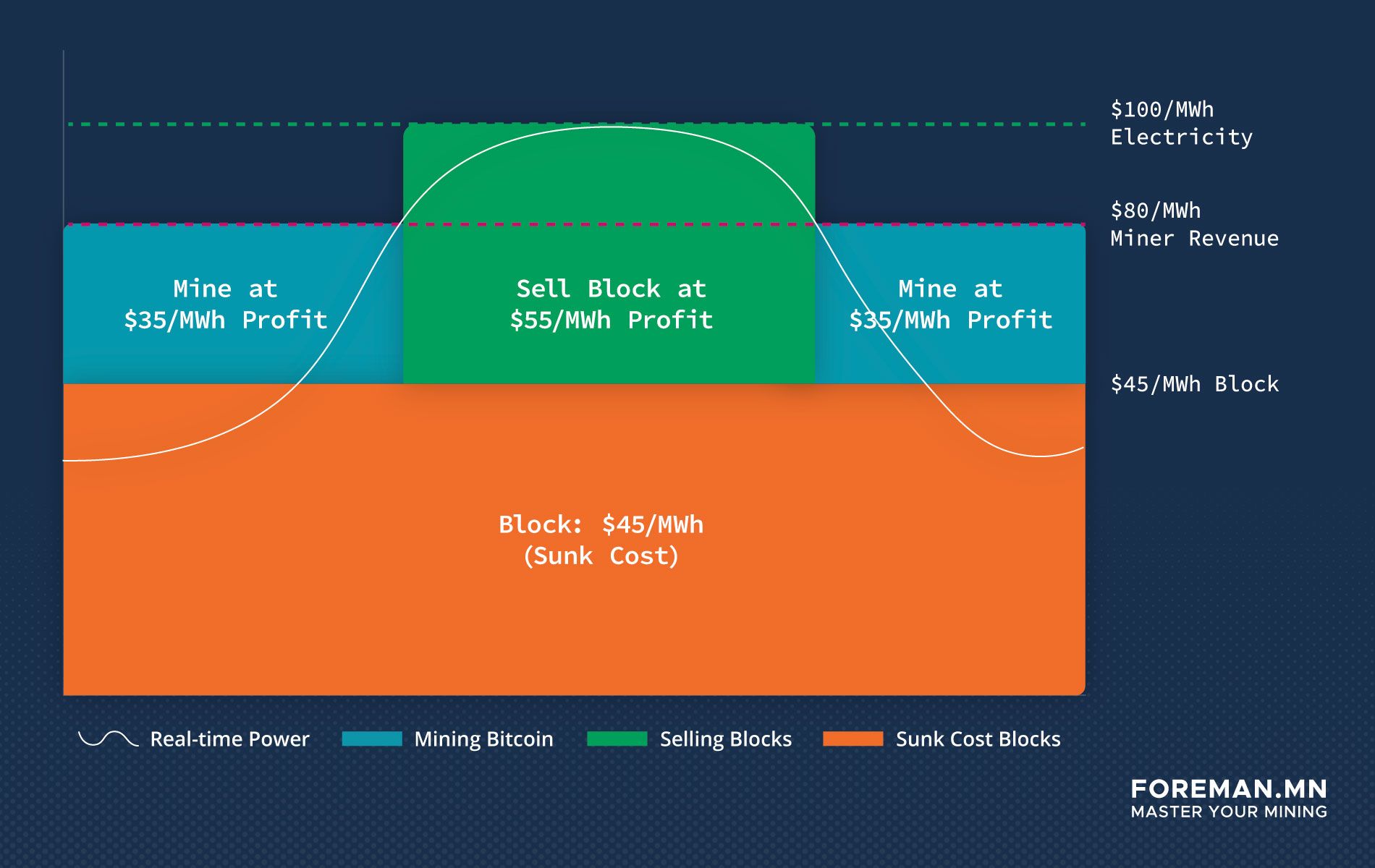

Miners will temporarily shut off their machines at the break-even point where mining costs exceed their revenue. However, instead of turning off machines and earning nothing, there is an opportunity to generate additional revenue on the other end of that transaction by owning the rights to the electricity block. Looking at the chart below, imagine instead of a miner simply turning off at the break-even with no revenue, the grid paid them directly for the electricity they supplied. This seems like it would be considered a `Demand Response` event, but it's not. It’s much more lucrative. So what would this look like in practice?

How Does It Work?

In the first installment of our Cost Saving Strategies, we examined the strategy of Peak Shaving, which involves shutting down miners at the break-even point to cut costs and avoid peak prices. But what if the miner owned that electricity and could sell their unused capacity back to the grid? This is referred to as “selling blocks” and differs from Demand Response programs. But it's only possible when working with retail energy providers that give the consumer the right to own the power. This is entirely separate from Demand Response.

“It is possible to double dip with Blocks and Demand Response, but if you are caught curtailing during a Demand Response window, you will be charged a fee for lack of participation.”

Here’s how it's broken down. An energy provider acts as a liaison between the miner and the energy producer, securing a specified amount of megawatts for a designated time frame, known as a “block.” The energy provider then locks in the electricity price for that block at an agreed rate, for example, $45/MWh. The miner can shut off and halt electricity consumption if the real-time or day-ahead prices go up. ERCOT or other ISOs recognize this and will sell the block at market value in that given period. So if the miner is mining at a revenue of roughly $80/MWh, anything above that means the miner could stand to make a larger profit margin. Suppose Electricity prices rise to $100/MWh. In that case, Foreman can curtail at the “break-even,” and the miner gets paid the difference, making a higher profit margin. At $100/MWh, that would be a 57% higher profit margin for that period.

So to reiterate, when the miner shuts off, the ISO recognizes that it pays the difference in whatever the real-time electricity rate is. In this, it is $100/MWh.

Zooming out and comparing that to the overall cost savings, as we showed in part 1, the added revenue is much higher. If we take the same data from electricity prices over the winter storm in ERCOT, the revenue from selling electricity blocks alone would be close to $120,000 simply from curtailing compared to making nothing at all.

The mechanism works the same way as it would if the miner shut off at their break-even point. There is no added complexity, the only difference would be the miner owns the rights to the electricity block and gets paid to curtail, and thus would be paid through the meter for what they didn't consume at the real-time electricity price.

Mining Bitcoin and Selling Blocks

Let's compare the above figure with the earnings from selling blocks and mining. The periods in which mining could have been more profitable during the winter storm were abrupt. In the last article, we showed that if miners were left on for only two hours, a 20MW facility would have lost $50,000 because electricity prices were pushing $4,000 per MWh, almost 100x above normal pricing.

The advantage of owning the electricity blocks means the miner owns the electricity and gets to “sell it back.” Turning off electricity shows on the meter, and the ISO sees that as curtailment, sending back revenue during the curtailed period. The miner will likely see that as a credit on their power bill. Adding the revenue of selling back that electricity above the break-even point now gives a wildly different chart.

Instead of simply making a profit of $94,000 from mining, the facility that takes the risk of owning the electricity blocks can stand to make more during a period of volatility from selling electricity than from mining bitcoin. Add those profits together, and that facility makes money on both ends of the transaction.

The miner that sold blocks and used Foreman to curtail during more profitable periods made $120,000 on top of the mining profits. This is taking a bad situation of electricity price volatility and using it as an advantage. The total earnings from this would be close to $216,000 rather than just sub $100,000.

Foreman allows miners to avoid peak prices and take advantage of the volatility, automatically capturing the arbitrage in electricity prices through selling blocks. Our platform makes this possible with real-time pricing and programmatic curtailment. Miners using these features can outpace the competition, often lowering their overall operating costs and ultimately becoming more competitive.

If you'd like to test Foreman, check our website and sign up for a free trial. If you are a customer and would like a consultation to take advantage of power blocks, reach out to us directly, and we can connect you with a retail energy provider. Cheers and happy mining.