The efficiency of Bitcoin mining machines has grown so much that it's hard to keep up. Facilities must continually replace old machines with new ones as their profit changes relative to the market. But what if we could peer into the industry average machine types and find out how profitable the industry remains?

This article will explore machine growth in efficiency and its dynamic relationship to industrial average electricity costs. There are multiple factors, and it is impossible to predict the exact measure precisely, but the article should help paint a general picture of where the industry stands as of July 2024.

Many leaders in the mining industry have done great work to advance our understanding, and their work continually enable understanding in our fast-paced world of Bitcoin mining.

Machine Growth Through Time

As the Bitcoin mining industry develops, ASIC manufacturers have become increasingly efficient at making new generations. Much like the computing industry, Moore's Law is reflected in new chips and fabrication.

When looking at mining from an infrastructure perspective, mines are built in specific locations and tend to have unchangeable electricity rates due to geography. As a result, efficiencies need to be increased in other areas, the first being the machine. Each machine model is more efficient than the last; thus, old generations have become obsolete for specific facilities and locals as time has progressed.

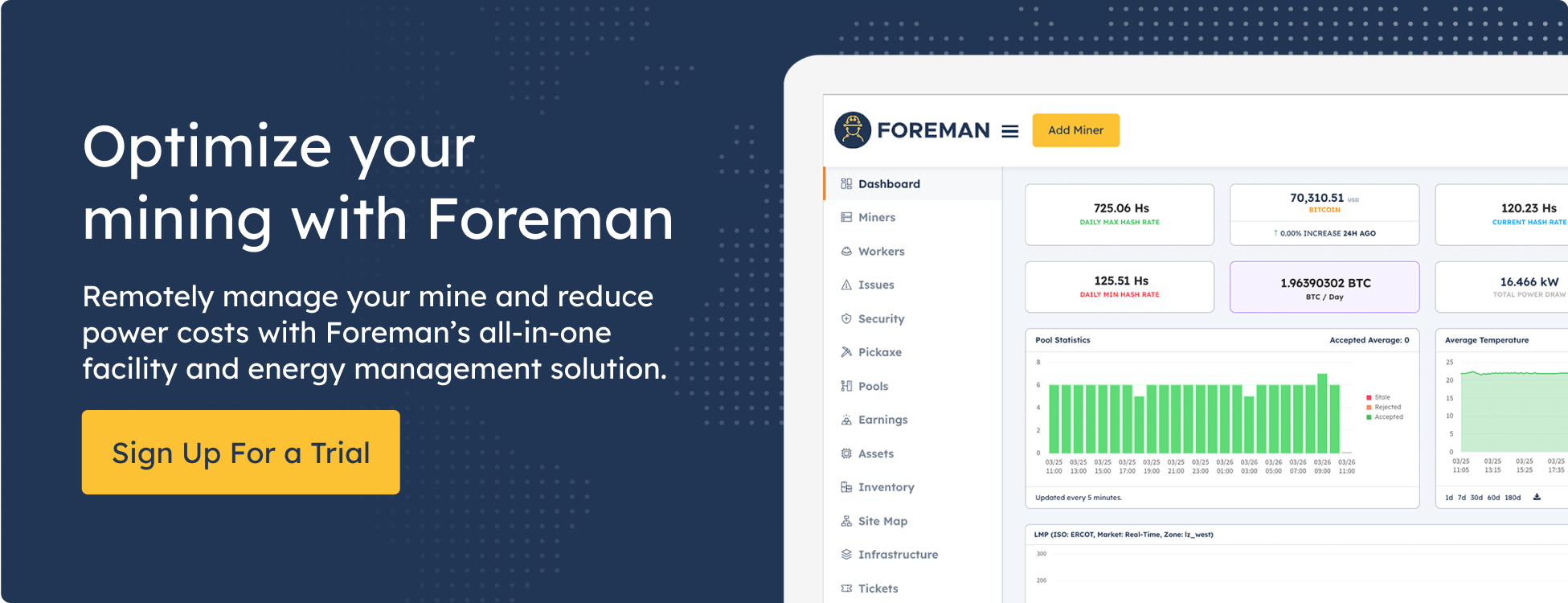

Facilities can also increase their efficiency in other ways, such as employing optimal power strategies and Demand Response. Miner management systems like Foreman have improved the overall optimization of facilities, but there is no alternative to replacing an efficient machine.

Measuring The Industry Average Efficiency

It has been notoriously difficult to understand the mixture of machines simply because there isn't a native measurement for this in the Bitcoin network. However, CoinMetrics and @karimhelpme found a way to identify the specific types of Bitcoin mining machines by analyzing patterns in the data they produce. They discovered that each machine type leaves a unique "fingerprint" in the nonces they generate. Collecting and examining many of these nonces, we can accurately determine which machines are being used and in what proportions. One of the results is a general average efficiency of the Mining network.

Creating the Mining Revenue Index is one way to utilize this industry average. Currently, hashprice is a metric that shows the dollars per hash the average network produces. This is great, but it does not show that the average changes over time. So, the metric's meaning diminishes as the average machine efficiency and difficulty increase.

To account for this, the Mining Revenue Index considers both hashprice and the growing efficiency of machines. It also aligns with energy rates by calculating the $/MWh in revenue form. That way, there is a solid alignment with energy markets.

Now, let's compare the Antminer S9 Revenue to the evolving Network efficiency. When S9s were the most prevalent ASIC on the network, the average efficiency was about the same. But as time passed, new machines were plugged in, and the efficiency increased. As a result, difficulty went up, and hashprice dropped. The gap between the S9 and the Mining Revenue Index widened as a result, and eventually became out of sync.

Combining Industry Average Electricity Rates To Find Profitability

The energy industry is a century or more old and has had plenty of time to mature. Outside of large localized events, the electricity rates don't seem to change much in the medium term or even over the past 10 years. Excluding abnormally high rate states, energy electricity rates stay around $60 per MWh on average.

The above data comes from EIA on a state-by-state basis for industrial electricity prices. The rates show a normal range by excluding many states, including NY and CA, for abnormally high electricity rates and ones that don't seem to have a large mining presence. This range is between $100/MWh and $40/MWh.

Electricity rates rose on average after the start of 2021 due to multiple factors, including inflation and money printing, and the energy crisis due to sanctions on Russia. These factors boosted electricity prices in the short term, but we might see them return due to elasticity.

Combining the Mining Revenue Index with the industrial average electricity rate of around $60/MWh shows a bottoming effect. The result of estimating an average electricity rate and comparing it to the Mining Revenue Index is that every time profitability gets to a certain level, there is a reflex.

Because hashprice combines both Bitcoin price and difficulty, the industry will naturally turn off when it is unprofitable. That is apparent in the above graph and could confirm the hypothesis that the current average electricity rate for the Bitcoin mining industry is $60.

The above graph should not be treated as an exact science, but as an estimate of where the industry starts to feel higher pain levels. I imagine this metric could be useful for many things as it relates to the industry. The Mining Revenue Index gives us insight into a once-concealed segment of our industry.