A Guide To How Bitcoin Miners And The Grid Mutually Benefit From Demand Response

The power grid is a complex system with diverse power production and fluctuating demand. For over a century, traditional power sources were responsible for providing predictable, flexible, and consistent supply to meet the demands of the power grid. With new power sources bringing more unpredictability, the grid has become fractured and unstable, leaving room for arbitrage. Demand Response (DR) incentivizes electricity consumers to adjust their behavior and better match their demand with the grid's supply.

Bitcoin mining is changing demand response, and it's happening with increased scale and volume. When and how Bitcoin miners adjust their energy usage is unmatched by any other industry. This article will discuss how Bitcoin mining is naturally symbiotic and synergistic with the evolving grid, how mining can resolve some of the grid’s pain points, and how it secures a reliable, flexible, and steady demand-supply balance.

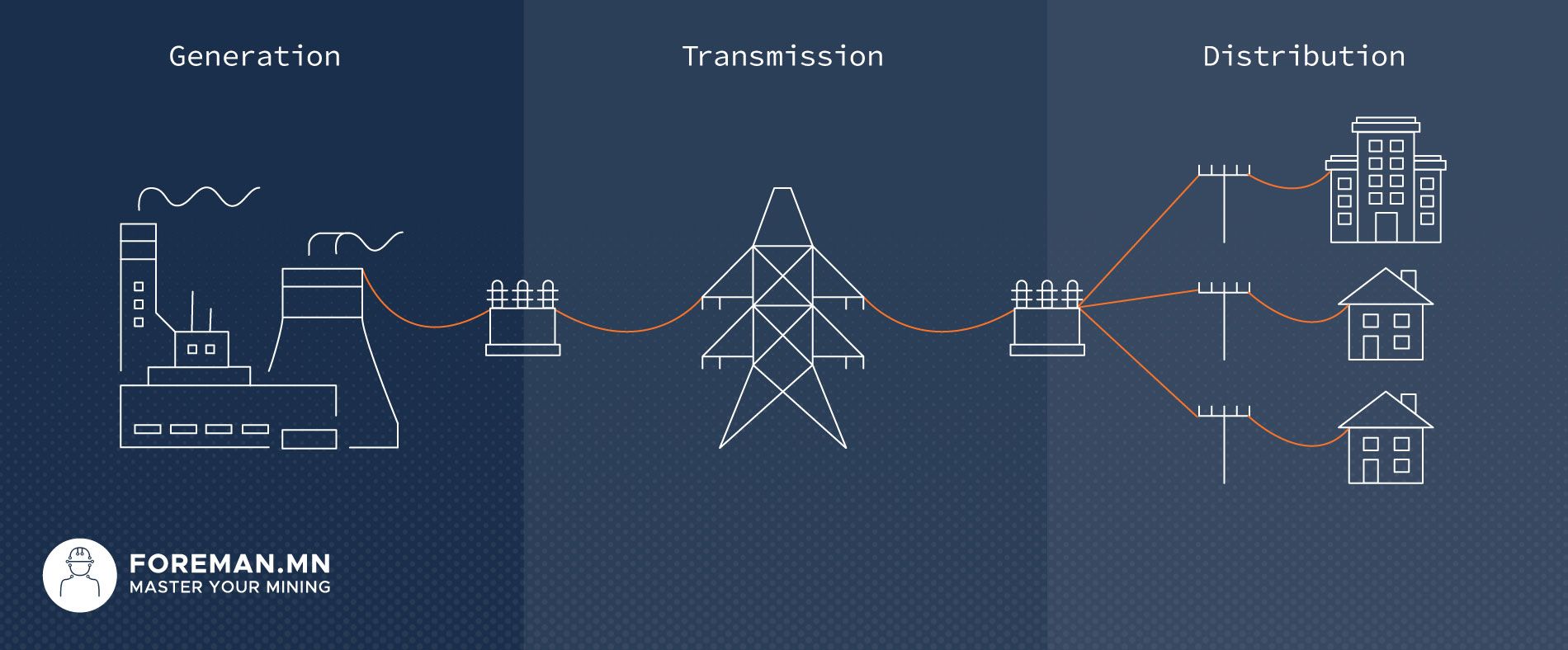

How The Grid Works

The United States power grid system is nearly a century old, with its infrastructure designed around the reliance on power producers seeking to meet consumer demand directly. Power plants generate electricity, and transformers increase the voltage so electricity can travel long distances through transmission lines, then another transformer steps down the voltage to safely match consumer needs.

One major issue with this system is that it must always be in a constant balance; if the power produced on the supply side is not equal to the power consumed on the demand side in real time, the grid shuts down or is potentially damaged. Since there isn't a scalable way to store excess electricity currently, energy must be consumed when it is produced on demand. If one side of the demand-supply equation is dynamic and fluctuating, the other must be flexible to maintain balance actively.

The primary indicator of this balance is the utility frequency. In the US, this is always maintained at about 60 Hz, slightly increasing with lower demand and decreasing with higher demand. One can think of this frequency as the heartbeat of the grid: minor deviations of this nominal frequency are standard, while large ones can lead to blackouts and disruptions.

Many variables must harmoniously coexist to sustain the frequency at a stable state. However, as more intermittent resources increasingly come online and replace traditional sources, maintaining the nominal frequency becomes more challenging, and more sophisticated solutions are necessary.

Current Grid Load Types

In the current grid, there are two major electric load types. The first, “base load,” delivers a consistent, continuous output needed to meet the minimum level of demand; two examples are coal and nuclear. The other type is “intermittent load." This intermittent load fluctuates, creating an unpredictable power supply, with solar and wind being two primary examples.

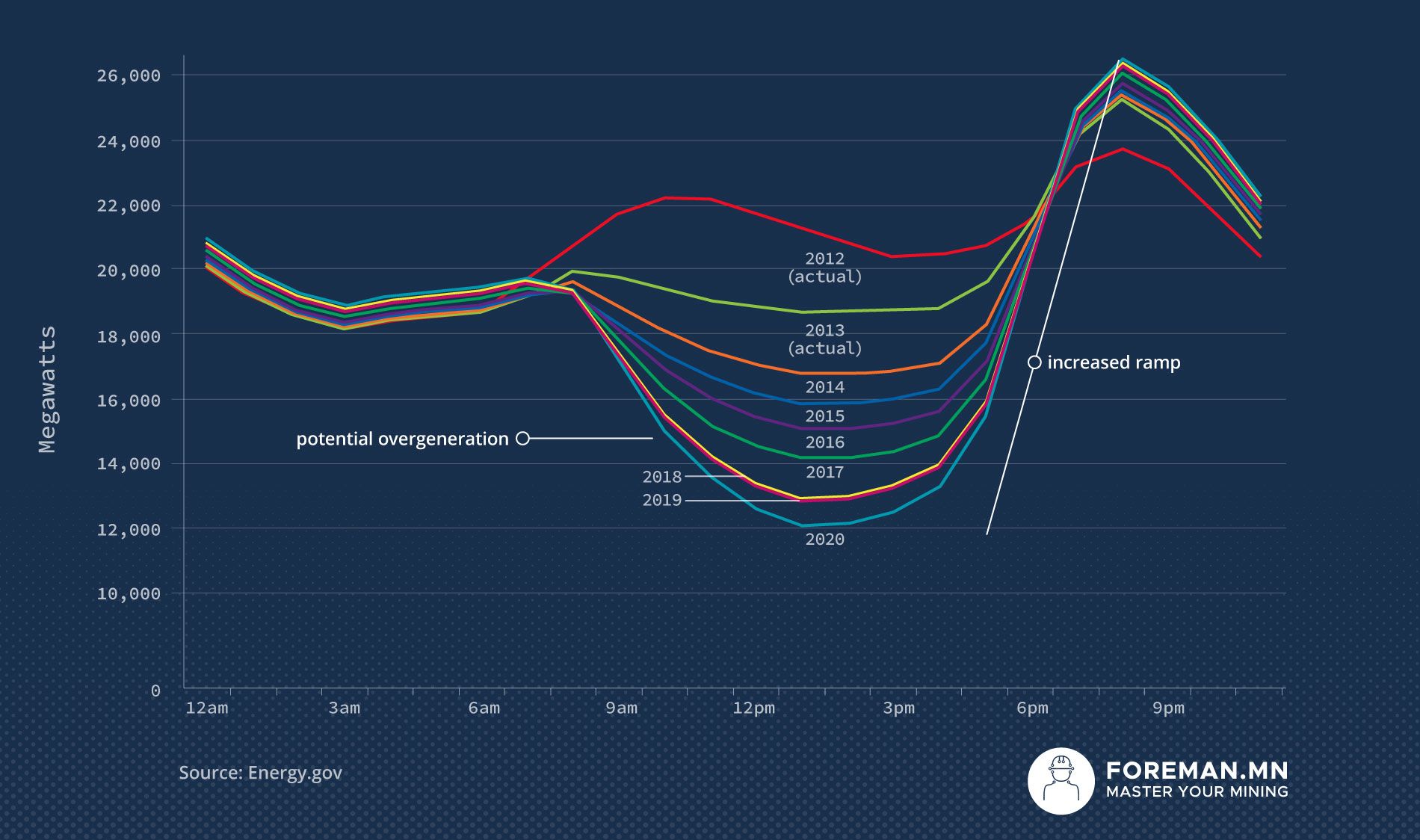

Daily fluctuations, mixed with the changing of the seasons, make these energy sources intermittent, introducing grid stress. Before widespread residential and industrial solar power, the energy demand curve was predictable, and power producers had a more predictable demand. With solar now producing a large amount of mid-day power, the curve has changed. It creates a dramatic period where production needs to ramp up quickly.

Peaker Plants

Times of unusually high or "peak" demand, such as during adverse weather events like a winter storm or a hot summer day, require fast and flexible additional power to supplement the base load. Peaker plants come online to help resolve dramatic fluctuations in the demand curve. Since they are quite expensive and less efficient than base load plants, peaker plants are typically used only occasionally.

What is Demand Response

Demand Response (DR) is curtailing or cutting back electricity consumption during peak demand. It is an opportunity for businesses to be compensated for providing power back to the grid. Currently, there are two sectors using demand response: residential and commercial.

Residential Demand Response

Power companies and utility providers often offer savings options, like decreased electricity rates during non-peak hours, to incentivize residential customers to limit consumption during peak hours. Some residential customers take advantage of DR through programs that give electricity providers access to their smart thermostats. Residential owners of solar often take this a step further, leveraging their household generation to reduce power bills during peak demand or even earning revenue by selling this energy back to the grid.

This new shift towards distributed power generation has some unintended consequences. Residential demand response and solar panels have resulted in what's known as the duck curve, representing a reduction in net power production (explained more in a later section). Solar supplies power back to the grid mid-day, forcing other power producers to shut down. The duck curve represents significant disruptions in grids, making the demand curve steeper. That ultimately means other power producers must quickly ramp up power production, pushing some producers to their limits.

Commercial Demand Response

At the industrial level, demand response allows power consumers to curtail and reduce electricity costs at scale. High-power consumers can lower monthly overhead by opting to participate in DR programs. One way of doing this is through a Curtailment Service Provider (CSP).

Curtailment Service Provider (CSP)

CSPs allow electricity consumers to participate in demand response programs. Based on the program, they may pay energy consumers to reduce or be available for usage during particular events. A spike in demand causes high electricity costs, and the CSP helps those enrolled anticipate these emergency events through system alerts and monitoring.

Current Industries Using Demand Response

Only specific industries can effectively participate in DR, with four key factors to consider: the cost of reacting, the reaction time, availability, and granularity. Arcane Research goes into depth on these properties, but here are two short examples.

Data Centers are high-energy consumers that can struggle with curtailment. If the data center shuts down, essential processes will stop, assuming server workloads aren't highly available. While data centers can quickly curtail with precision, they have a high cost to react.

Production Plants such as aluminum, steel, and industrial manufacturers can utilize DR, but not without cost. The price to curtail must offset the cost of production. The cost to curtail, reaction time, and where the plant is in the production process all factor into DR. Production plants will likely need additional time to perform if they curtail.

Bitcoin and Demand Response

Bitcoin mining has properties that few energy consumers have at scale. Miners can quickly turn off without affecting the Bitcoin network, providing power to the grid at a moment’s notice, and creating a reservoir of emergency electricity. Although curtailment isn't new, it has not been available at this scale with such precision. Bitcoin mining, as a new tool for demand response, essentially upgrades and provides an operating system to the century-old power grid.

Mining facilities have an advantage where they can curtail because users aren’t directly affected. This allows for two sources of revenue: block rewards by supporting the Bitcoin network and demand response dollars.

Why Bitcoin Mining Is The Best Load-Balancing Tool

"Demand Response is the key to unlocking the power of flexible loads for our grid systems. Bitcoin Miners are more responsive and faster-acting than any other kind of industrial, commercial, or residential load, which makes them akin to a demand-side battery. Our Texas electric grid and others across the nation are adjusting to accommodate a more diverse energy mix, including more intermittent energy sources. Bitcoin mining can function as a better, faster demand response tool that can essentially act as battery storage or ancillary power plant, playing an important role in grid stabilization." - Lee Bratcher, President of the Texas Blockchain Council

Cost Of Reacting

A company will typically only reduce its electricity consumption if it is financially beneficial for them to do so from the perspective of opportunity cost. In other words, the payouts from utility providers for reducing electricity consumption as part of demand response must be higher than their cost of reacting (or running their everyday business as usual).

Through curtailing, there is no actual accrued cost since the miners are simply powering down. People rely on cloud-based services, so if a data center curtails, consumers may be affected (imagine if Netflix went offline for 6 hours). With Bitcoin miners, there is no cost to the facility, and it is trivial to turn the miners on and off with the right software. There is no cost to the network as well; the difficulty changes (within two weeks), and other miners pick up the hashrate for the next block. Miners will switch between curtailment and mining based on which is more profitable.

Reaction Time

Bitcoin miners can immediately pivot when there's peak demand. While it takes hours or days for some manufacturing facilities to curtail, a miner can shut down remotely in under 60 seconds. This reaction time lends itself to a new spectrum of fast-acting demand response, paving the path for more aggressive programs in ERCOT, PJM, and NYISO. If there is a weather event, miners can prepare to curtail while still mining. If there is a last-minute emergency shutdown on short notice, miners or facilities participating in demand response can quickly divert power to where it's needed.

Additionally, automated software layer solutions are improving reaction time even more.

Availability

When customers can reduce their consumption without disrupting their daily business, availability is at its peak. If a process is continuously running at full capacity, it will always be able to reduce consumption and provide that additional power back to the grid in times of stress. The more available the power is, the more stable and better suited the industry is for usage as DR.

Bitcoin needs mostly consistent power consumption for mining to be profitable. Miners are continually humming to hit their ROI. The economics of mining are such that every ten minutes, a block is mined based on luck, and if the miner is not plugged in, they miss out on potential profits. The continual growth rate in technology and competition also increases the speed at which a miner will get priced out by the market. Miners tend to plug in ASICs quickly for those specific reasons. When a CSP or another entity requests curtailment, the availability is almost always there, making it particularly high.

Granularity

At a mining facility, curtailments can be run individually on as many machines as desired and required. Hence it is very granular down to individual machine levels, as low as a few kilowatts. This control over the power and hashrate of each miner allows Bitcoin mines to adjust to the precise detail and power needed. If there is a 2-megawatt facility, and the grid needs only 1 megawatt, miner operators can either shut down 1 MW of machines or underclock them all to 50% power. If some machines are less efficient, those machines can be cut first, leaving the most efficient ones running.

The Best Load-Balancing Tool

Combining the low cost to react, quick reaction time, high availability, and an infinitely granular scale: you get an extremely powerful grid balancing tool. The continual growth of hashrate means an increase in the breadth and depth of the market. The breadth is a further outward spread and saturation of hashrate worldwide that lends the opportunity for more curtailment. The depth means an increased wattage and capacity in mines.

This quickly growing industry and the most powerful demand response tool known to date creates a new way to supply power to the grid in times of stress. Bitcoin mining expanding industry and precise demand response tool opens the door to a more stable and cheaper power grid.

Miners Benefit From Demand Response

Profits are highly volatile in the mining industry, and difficulty continues to rise as more miners plug in, driving down margins and creating a race to zero for power prices. This volatility makes it a difficult industry, so saving costs wherever possible is something that needs to be done for every participant.

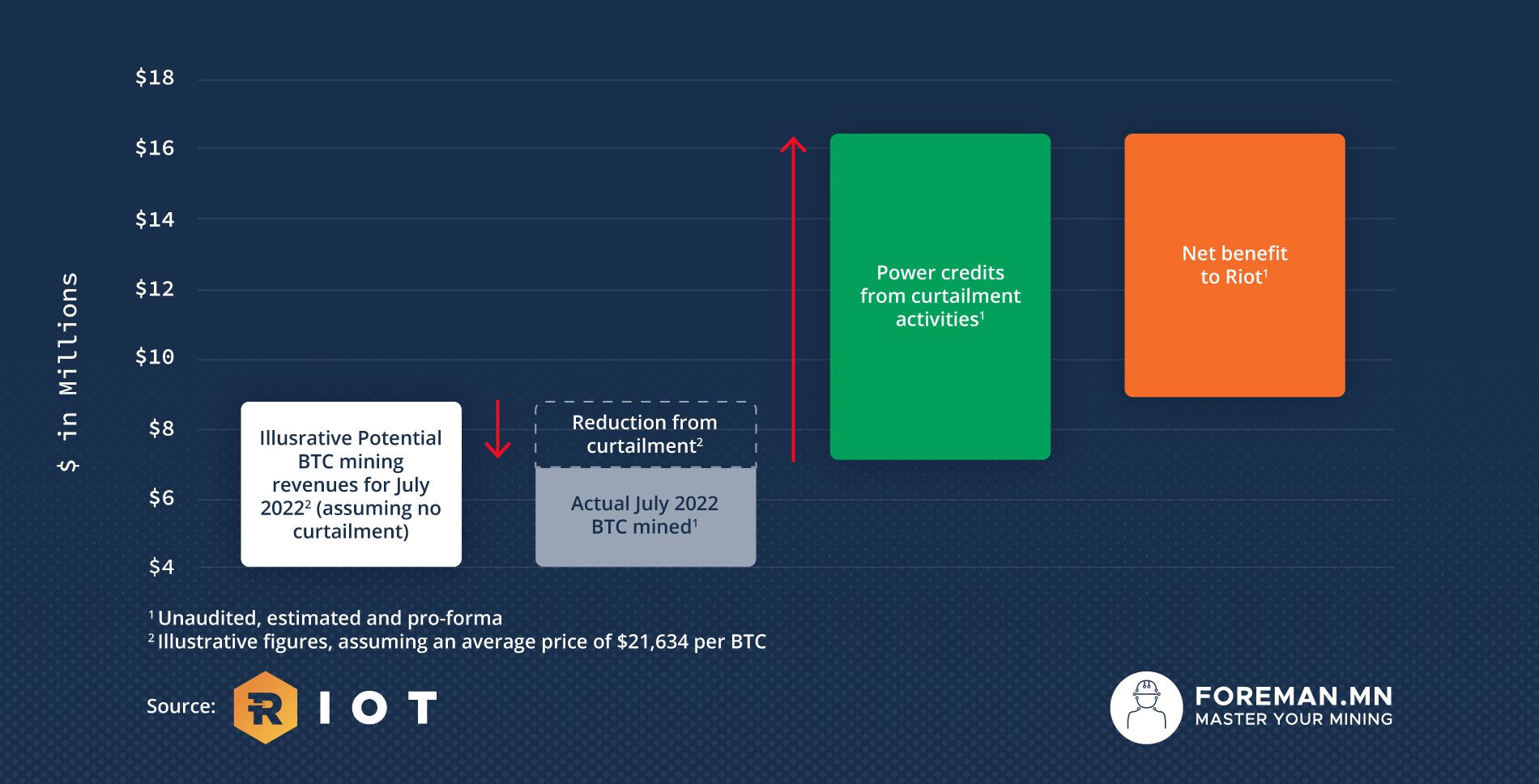

Riot, the largest miner in Texas, published a report showing curtailment during a summer heat emergency response event brought much more profit than what could have been done with miners alone. In July 2022, the miner produced 318 BTC while at the same time curtailing and sending power back to the grid. According to Riot, the curtailment activity resulted in power credits of $9.5 million, or around 439 BTC. This totaled the equivalent of around 757 BTC and paid for the entire month's electricity. That is a 180% increase from the month prior.

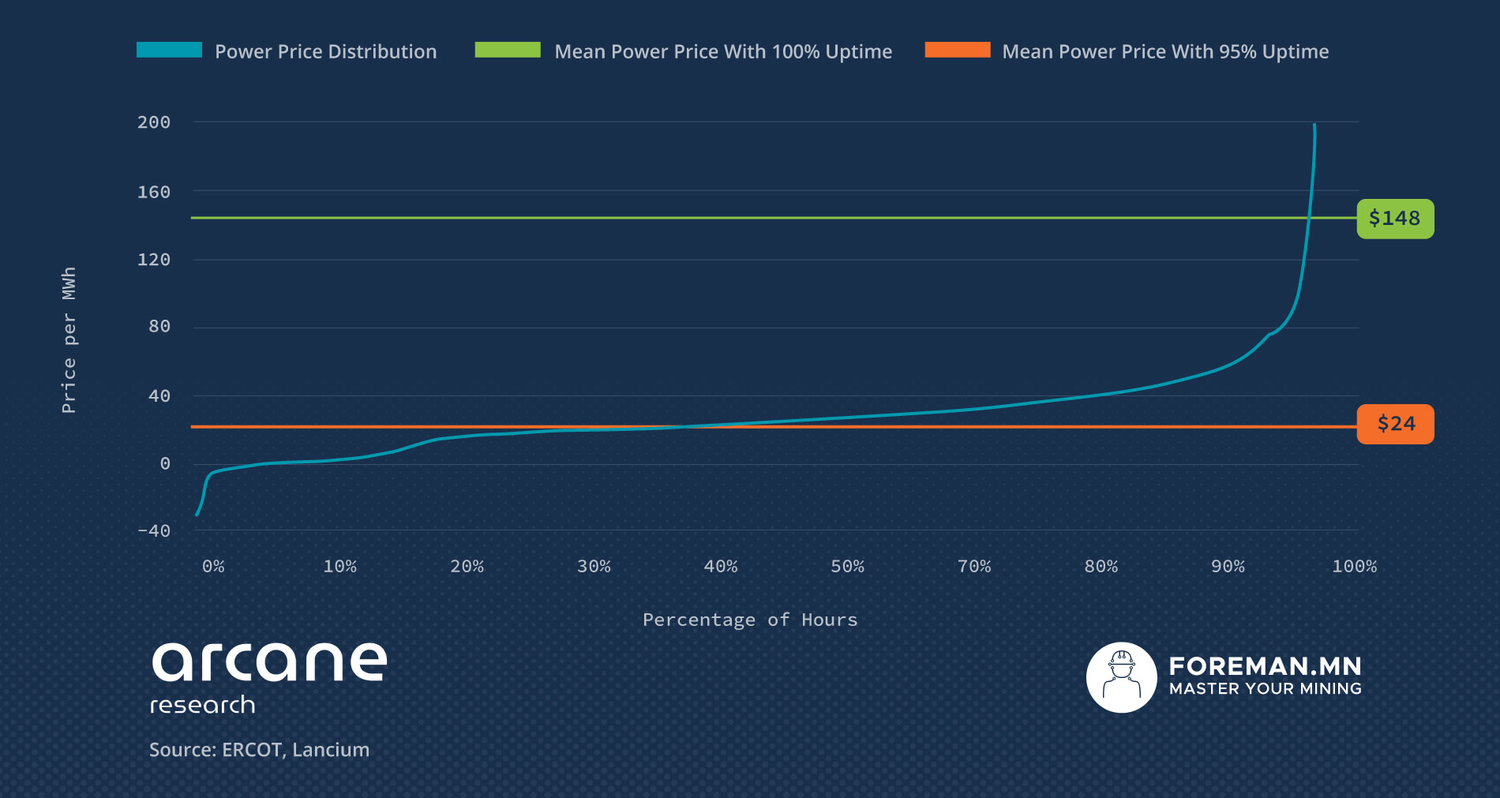

These emergency response events happen multiple times a year. Other curtailment techniques, such as Peak Avoidance, present opportunities weekly and could net more profit in the long run. Arcane Research’s report on Bitcoin mining and the energy grid studied the effect of percent power curtailment and what that does for miners' profits. The study was done in west Texas using wind and solar power generation, showing that a 95% uptime resulted in significantly lower average power prices. With a 100% uptime, the electricity costs would have resulted in an ROI of 6,203 days, while 95% turned out to be a sweet spot of 502 days.

Why Should Miners Participate In Demand Response?

The simple answer is that it is cost-effective. In a new and booming industry, competition is always looking for an edge. Leveraging the ability to curtail during peak demand could impact the bottom line and save costs. This is just one of the tools in the tool belt that could change the trajectory of a mining operation.

The Grid Benefits From Miners

Because of its properties, Bitcoin mining significantly changes the power grid. It reduces the grid's reliance on peaker plants and creates new ancillary power units.

Demand Response Disrupts Peaker Plants

Currently, Peaker Plants are performing the role of a reserve energy resource. They are expensive to run as they only turn on when the demand and electricity are high. The plants are also sometimes slow to get up to speed, needing a forewarning. Bitcoin miners could potentially replace peaker plants and reduce the cost of on-demand electricity reserves. Instead of expensive peaker plants only turning on when demand is high, ancillary power plants are low-cost and available to supply power to the grid in times of need.

Miners Create Ancillary Power Plants On The Grid

Stranded gas is an excellent example of Bitcoin miners creating and funding ancillary power generators. Because of location, if an oil well doesn't have a connection to a gas pipeline, it's very expensive to install one. The well is restricted by distance from a pipeline and how much it produces. So instead, Bitcoin miners such as Giga Energy have been dropping generators on-site to produce power and capitalize on what would have otherwise been wasted flared gas.

But that generator has another use. It can hook up to the electrical grid and provide demand response utility. When demand is high and power prices squeeze profit margins, miners can curtail and earn power credits to cut costs. Extrapolate this into every market area where there is arbitrage in power prices and an opportunity to cut costs through curtailment. Bitcoin miners create ancillary power plants, funding them and creating a more stable and cheaper grid.

The Changing Power Grid

"Bitcoin mining is an elastic load that can be incentivized to curtail and free up power in response to high electricity prices during any grid scarcity event. This load resource in conjunction with software companies like Foreman present an opportunity for grids to evaluate Bitcoins responsive load as additional tool for increasing reserves and resilience of grids with the right incentivizes. Higher intermittent renewable penetration, aging infrastructure, and increased electrification are stressing grids globally. Bitcoin minings' off peak consumption and ability to curtail should be seen as a new funding mechanism to incentivize and pay for more generation and infrastructure. Texas has always been a world leader in energy innovation and ERCOT is showing the world how technology and mutually beneficial bottom up solutions lead to more reliable and affordable power for all. " - Gideon Powell

The world is changing, and with changes in energy production come new and unpredictable changes to the grid. Demand response for Bitcoin miners is highly economical and, in fact, one of the few industries that can supply power at scale when needed. No one saw it coming, but Bitcoin mining has become an industry that creates incredible opportunities for how the grid can function synergistically with more integrated renewables at scale.

New and exciting ways of dampening demand curves are presenting themselves. A more reliable and safe grid seems possible with demand response and nurturing funded ancillary power units through Bitcoin mining. Bitcoin mining is the best tool to protect our power grid now and for future generations.